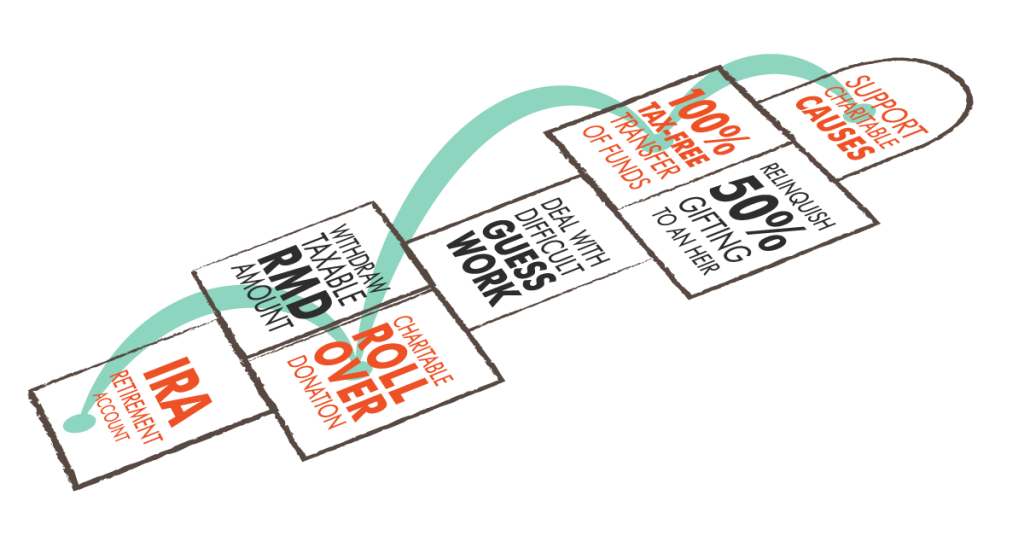

If you are age 70 ½ or older, own an IRA and make charitable gifts, you may be familiar with the IRA Rollover—also known as a qualified charitable distribution.

This provision allows individuals aged 70½ and older to transfer up to $100,000 of Individual Retirement Account (IRA) assets to a public charity without triggering current federal income taxes, or future estate tax. In addition, the qualified charitable distribution omits the full amount of the donation from gross income for tax purposes. These benefits are available to taxpayers regardless of whether or not they itemize their returns.

According to the Independent Sector, “this helps older Americans who may have paid off their home mortgage and no longer file itemized tax returns. The mandatory distribution from their IRA would otherwise trigger a tax burden, even if they donate the money to charity. The IRA rollover provision removes these negative tax consequences and encourages Americans to give back to their communities.”

According to the Independent Sector, “this helps older Americans who may have paid off their home mortgage and no longer file itemized tax returns. The mandatory distribution from their IRA would otherwise trigger a tax burden, even if they donate the money to charity. The IRA rollover provision removes these negative tax consequences and encourages Americans to give back to their communities.”

In more technical terms, gifting you IRA charitable rollover to charity counts toward your required minimum distribution (RMD). Because of the RMD rule, some IRA owners find they must withdraw (taxable) funds they don’t need from their IRA. For them, using those funds in a tax-free way to support causes they care about is particularly attractive.

Making a charitable rollover gift from an IRA as opposed to other assets may be especially appropriate if:

- you do not itemize your deductions,

- you would not be able to deduct all of your charitable contributions because of deduction limitations, or

- an increase in your taxable income may negatively impact your ability to use other deductions.

Certain limitations apply to these non-taxable charitable distributions from an IRA:

- They cannot exceed $100,000 per person per year or $200,000 per married couple (provided they have individual IRAs).

- Distribution is not included in taxable income.

- The distribution must be made directly to a public charity such as the Community Foundation for Southwest Washington, and they cannot be to a supporting organization, private foundation or donor advised fund.

- The gifts must be outright. For instance, they cannot be used to establish a gift annuity or fund a charitable remainder trust.

- No goods or services, such as tickets to an event, can be received in exchange for the contribution.

- Applies only to Traditional and Roth IRAs, not other types of retirement accounts.

Millions of Americans continue to save pre-tax dollars in their IRAs, often amassing more than they need for daily living expenses. According to experts, these assets are not ideal to pass to future generations, because heirs sometimes won’t even receive 50 percent after taxes.

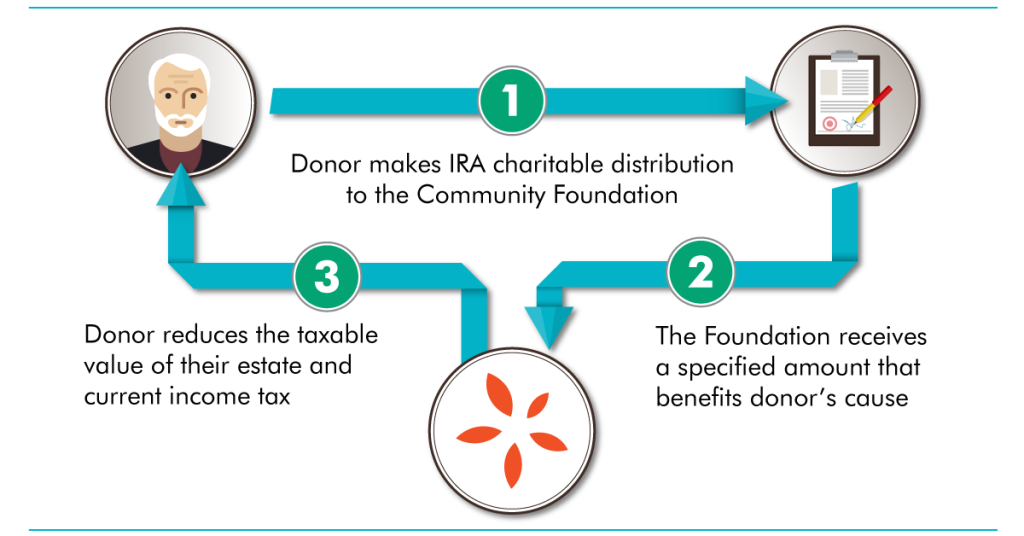

The impact of the IRA charitable rollover can be seen in the hundreds of millions of dollars donated to charitable organizations since 2006. It has benefited a number of nonprofit organizations in our community, including the Community Foundation for Southwest Washington. So, how does it work? The graphic below explains the IRA charitable rollover in three steps, assuming the donor is using the Community Foundation for Southwest Washington as a beneficiary.

At the Foundation, charitable rollovers can impact lives through the Community Giving Fund, which supports our Focus Grants program. Your gift can also be made to our General Scholarship Fund, Administrative Endowment, General Fund or any of the open designated, field of interest or scholarship funds created by our thoughtful donors over the years.

If you would like to know more about the benefits associated with the IRA Rollover and how to make this type of gift, please contact us today. Our team is ready to assist you and offer advice on which funds offer the right fit in pursuit of your charitable goals.