From Buffet to Zuckerburg, billionaires steal the headlines when it comes to charitable giving. The extra coverage might make one think that mega-donors are fueling modern philanthropy. But that conclusion couldn’t be further from the truth. Every cent has an impact, and almost everyone can find ways to save more for giving.

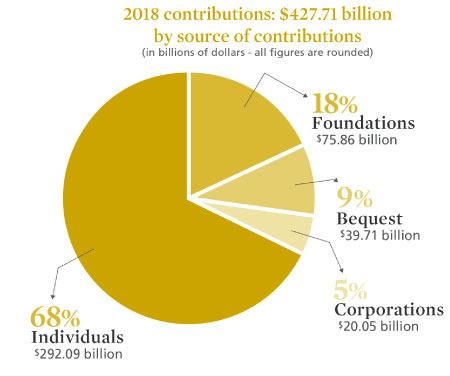

If you don’t believe your dollars make a difference, take a look at the 2019 Giving USA Report. Small gifts represented the bulk of giving in the United States last year. As you can see in the chart here, the same was true the year before. In fact, America’s rich history of philanthropy is built on millions and millions of modest, but mighty, gifts.

If you don’t believe your dollars make a difference, take a look at the 2019 Giving USA Report. Small gifts represented the bulk of giving in the United States last year. As you can see in the chart here, the same was true the year before. In fact, America’s rich history of philanthropy is built on millions and millions of modest, but mighty, gifts.

Giving more doesn’t take millions of dollars; just a caring heart, a little generosity and some saving. Just ask Paddy Hough. Still, the thought of giving money away can seem out of reach for many.

This is what led the Community Foundation to launch southwest Washington’s online giving day–Give More 24! We wanted to make local giving more approachable, accessible and fun. Our vision: show the powerful impact of collective giving.

So, in the spirit of giving back, we’re offering a few tips to help you save more for giving during Give More 24! and throughout the year, no matter your financial situation.

Save More for Giving

There are easy ways to trim your spending without losing anything you love. Here’s a list of our favorites:

-

- Cream in Your Coffee: We’ve all heard variations on what our morning coffee can buy us, and it’s often true. One report says Americans spend an average of $1,100 at coffee shops each year. So, if your morning routine includes stopping at a local cafe for a sweet treat, you might save hundreds by cutting back or switching to a drip coffee. If you need a daily boost, try making it at home or work.

- Information Overload: Today’s news and entertainment offerings are tough to keep up with. Review your subscription usage and try to find ones to cancel, or at least downgrade. For instance, you can drop paper delivery for an electronic version? Even cutting cable or throttling back your Internet speed can save hundreds a year. Give it a go, and if buffering becomes unbearable, you can always bump up your plan again.

- Making the Bacon: American households spend an average of $3,008 every year eating out according to the Bureau of Labor Statistics, and that might be generous. Today, 90 percent of Americans dislike cooking, even though homemade meals save you tons of cash and possibly a few pounds. You don’t have to cut out celebratory dinners or traditions. Instead, start getting your dining budget in order by eliminating convenience meals like takeout nights and fast food lunches.

- Primping & Playing: We all make choices when keeping appearances and filling our time, and these choices impact our pocketbooks. See if you can cut down on haircuts, pedicures and other grooming needs. As for fun, seek out free or inexpensive activities. Take advantage of community events like festivals, markets and fairs. Every moment enjoyed is twice as good when you realize that you’re saving cash.

- Less Please: Financial pros use the term “lifestyle inflation” to describe our tendency to spend more as our income increases. The smart play is to save that extra cash for lasting and fulfilling purposes, such as retirement or giving. Honestly, the biggest thing to cut from your life and your budget is the constant pursuit of upgrading. Breaking this conditioning is tough, but it leads to positive outcomes.

Less Brings More

Setting something aside for giving takes something out of your wallet, but it also adds something to your life.

Giving provides more meaning. While intangible, the fulfillment of connecting with caring neighbors, investing more in your community, strengthening personal values and listening to your social conscience are rewarding on a personal level.

Giving provides more meaning. While intangible, the fulfillment of connecting with caring neighbors, investing more in your community, strengthening personal values and listening to your social conscience are rewarding on a personal level.

Giving also provides more joy. Research has shown that giving activates reward centers in our brains, explaining why it feels better to give than receive. Whether it’s providing general support for a cause you love or contributing to a tangible immediate need, you can feel good about helping out and also know that you’re getting something invaluable in return.

If you need even more, there are also benefits related to health and taxes. You get the picture though. The more thoughtfulness we apply to our finances, including those dollars we plan to give away, the more benefits we reap.

By putting our tips to work and finding a cause to support with your savings during Give More 24!, you might also bank more happiness, health and hope this year.