This year has been one filled with both unexpected turns and invigorating surges of hope. I want to acknowledge our donors for being equal parts proactive and responsive to a range of emerging community needs. Thank you for making possible our region’s ability to adapt and overcome several challenges. As 2021 coming to an end, the Community Foundation wants to ensure your donations have the strongest impact on the causes you care about while also making the most of your tax advantages. We invite you to consider a few giving strategies to optimize your end-of-year giving experience.

1. Leveraging CARES Act charitable incentives

Last year, I wrote extensively about how the CARES Act provides significant incentives for charitable giving. Several provisions were extended or expanded to 2021, which I’ve listed below. These tax benefits expire on December 31, so make sure you plan your giving accordingly before they disappear.

- $300 Deduction for Claiming the Standard Deduction: Those planning to take the standard deduction for their 2021 tax returns may claim an above-the-line deduction of up to $300 for cash donations to qualifying public charities like the Community Foundation.

- $600 Deduction for Married Couples: This year, the above-the-line deduction has been increased to $600 for cash donations for married couples filing jointly and do not itemize tax deductions.

- Charitable Giving Deduction Limit Increased: Donors may continue to receive a federal income tax deduction for charitable contributions of up to 100% of their AGI for certain cash donations made in the 2021 calendar year. Before 2020, this limit was previously set at 60%.

- AGI Limit for Cash Contributions Increased for Corporations: The AGI limit for cash contributions remains increased for corporate donors. Corporations can deduct up to 25% of taxable income. This number was 10% prior to 2020.

2. Donating appreciated stock or mutual funds

Regardless of the state of the world, domestic financial markets have been performing well. If you have stocks or other publicly-traded securities that are worth more than what you paid for them, consider using these assets as charitable gifts this year. Gifts of appreciated stock and mutual funds have the double tax benefit of avoiding capital gains tax on the appreciated value, while receiving a deduction for the fair-market-value of the appreciated gift. Please consult your tax advisor because there are some deduction limits to stock donations depending on your income and situation.

The Community Foundation can accept marketable securities of any kind. However, we recommend initiating year-end mutual fund and stock gifts by Thursday, December 23 in order for us to receive your gift and for you to realize tax benefits this year.

3. Giving from an IRA to reduce future RMD

Charitable IRA Rollovers is a giving strategy that allows you to avoid paying income taxes on your Required Minimum Distribution (RMD), while supporting your favorite causes in the community. For those who take the standard deduction, QCDs offer a way to make a charitable gift and enjoy tax benefits similar to an itemized income tax charitable deduction.

While rollovers to Donor Advised Funds are not allowed, donors who are 70 ½ or older can direct qualified charitable distributions (QCDs) of up to $100,000 per year toward other funds at the Community Foundation, such as our Social Justice and Resiliency Fund. You also have the option of creating a Designated Fund, Scholarship Fund or Field of Interest Fund with your distribution. To take advantage of this opportunity funds must leave your IRA before the RMD deadline. In addition, we recommend initiating your contribution by Monday, December 27 to ensure the gift is received this year.

4. Bunching gifts to exceed standard deduction

4. Bunching gifts to exceed standard deduction

The Tax Cuts and Jobs Act of 2017 nearly doubled the standard deduction ($12,550 for individuals, $25,100 for couples), making it difficult for some to receive a significant annual tax benefit from giving. One solution: bunch or “pre-fund” your giving. This giving strategy combines multiple years worth of donations into one annual gift to a Donor Advised Fund at the Community Foundation. You’ll maximize your deduction now, while spreading out grants to your favorite charities over time and benefiting from the standard deduction in later years.

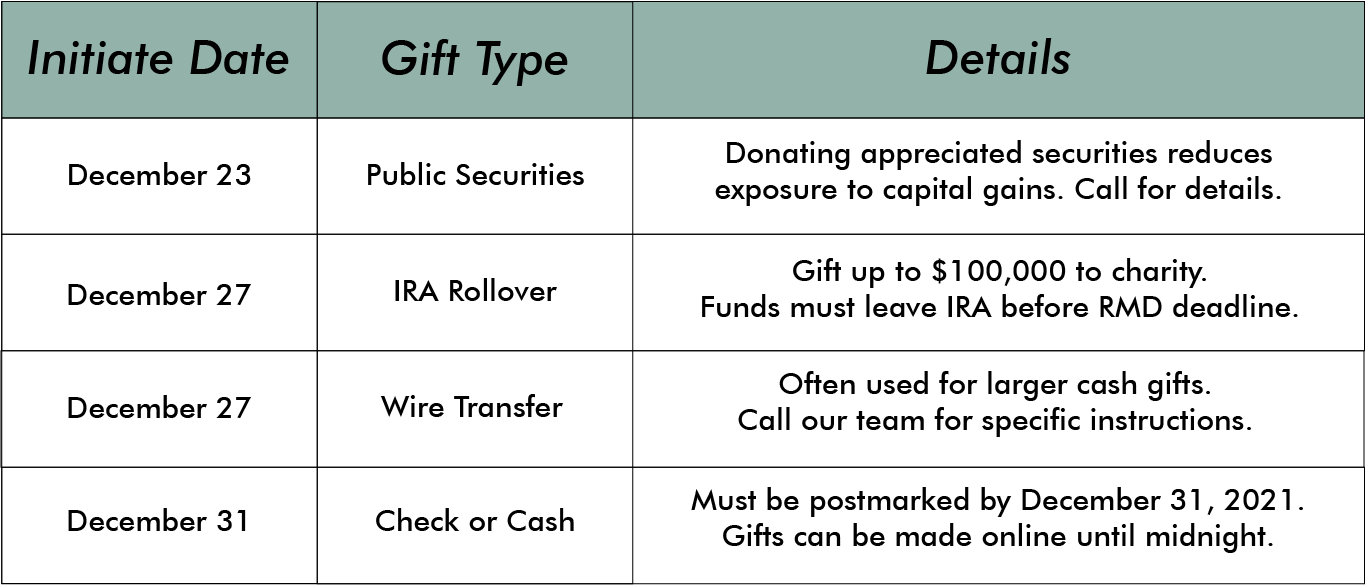

You can establish a Donor Advised Fund in one meeting. However, depending on the assets you’re contributing, the timeline for giving may vary. Refer to our end-of-year giving schedule below for specific deadlines on different assets.

Plan and time your giving strategies accordingly

Planning and timing your giving is critical. By working with the Community Foundation, you gain access to our extensive knowledge on charitable giving strategies and local nonprofits. Using our tools and expertise, we can help you define and achieve your charitable goals.

Speaking of goals, let’s talk timing. If you are aiming to make a contribution before the end of the year, these dates will assure that we can provide you with exceptional service and still guarantee a 2021 tax deduction for your gift.

Our online donation form is always a great option for those giving cash gifts with a debit or credit card. For assistance with other contributions, including gifts of stock, please reach out to me or our Chief Financial Officer, Pam Cabanatuan. We are available every weekday from 9 a.m. to 5 p.m., with the exception of Friday, December 25. We’re always happy to assist, because we understand the urgency and importance of giving—especially in today’s world.

Our online donation form is always a great option for those giving cash gifts with a debit or credit card. For assistance with other contributions, including gifts of stock, please reach out to me or our Chief Financial Officer, Pam Cabanatuan. We are available every weekday from 9 a.m. to 5 p.m., with the exception of Friday, December 25. We’re always happy to assist, because we understand the urgency and importance of giving—especially in today’s world.

Please note: The Community Foundation for Southwest Washington is not a licensed tax advisor. Donors should work with their financial, tax or legal professional to determine the best charitable giving strategy for their situation.